If you’re looking for a career in the tax industry, set your sights high! While it doesn’t take much to become a tax preparer and start preparing taxes for the general public, earning a credential as an Enrolled Agent should be the ultimate goal.

Enrolled Agents are the only credentialed tax preparer and thus have instant credibility, they also have unlimited representation rights and the knowledge to prepare complicated tax returns (thus they earn more money).

Benefits of Becoming an Enrolled Agent

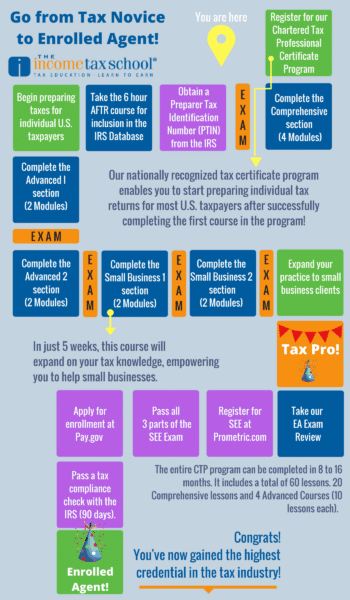

While it may seem like a long road, becoming an Enrolled Agent is an attainable goal that can easily be tackled with the help of The Income Tax School. Our nationally recognized Chartered Tax Professional Certificate Program will not only provide you with the education you need to prepare taxes, you’ll learn everything you need to know to pass the IRS EA Exam. Here’s a guide to your path as an EA.

Step 1: Register for our Chartered Tax Professional Certificate Program

Our Chartered Tax Professional Certificate program can be taken completely online. It includes a total of 60 lessons: 20 comprehensive lessons and 4 advanced courses (10 lessons each).

Step 2: Complete the Comprehensive Section

Once you’ve completed the 4 module comprehensive section, you will have the knowledge you need to start preparing individual tax returns for most U.S. taxpayers.

Step 3: Obtain a Preparer Tax Identification Number (PTIN) from the IRS

In order to prepare taxes for compensation, the IRS requires that you register with them and obtain a PTIN.

PTIN Requirements for Tax Return Preparers

Step 4: Take the 6 Hour AFTR Course

The IRS Annual Filing Season Program (AFSP) is an annual voluntary IRS tax training program for return preparers. It aims to recognize the efforts of non-credentialed return preparers who aspire to a higher level of professionalism. Those who pass earn a Record of Completion, are given limited representation rights, and are listed on the IRS Federal Tax Return Preparers Directory. This list is being marketed to taxpayers through a public education campaign that encourages taxpayers to select return preparers carefully and seek those with professional credentials or other select qualifications.

IRS Annual Filing Season Program (AFSP)

Step 5: Begin Preparing Taxes for Individual U.S. Taxpayers

You’re officially capable of preparing taxes for the general public! Seek employment with a tax firm in town or go out on your own!

Step 6: Continue Your Education

Keep working your way through our CTP course. You’ll take the Advanced 1 and Advanced 2 sections to learn how to prepare more complicated tax returns. Next, you’ll tackle the Small Business 1 and Small Business 2 and learn to help small businesses with their taxes.

Step 7: You’re a Tax Pro!

Once all courses are completed, you will have the knowledge you need to prepare taxes for anyone – and to start preparing for the EA Exam (called the Special Enrollment Examination). The entire CTP program can be completed in 8-16 months. As you work through the program, you can gain experience as a tax preparer. Once you’ve completed the program, you will receive a certificate from The Income Tax School that can be framed and displayed on the wall in your office.

Step 8: Take Our EA Exam Review

The Income Tax School offers an EA Exam Review through a partnership with ExamMatrix. ExamMatrix’s groundbreaking EA Exam Review Software has completely changed the landscape of EA Exam Review preparation. They offer an “Adaptive Learning” technology where students experience a personalized study program that accommodates your busy schedule.

Here are some study tips: How to Study for the Enrolled Agents Exam

Step 9: Register for and Take the SEE

Register for the SEE at Prometric.com. You will need to create an account and then schedule your exam.

There are three parts to this exam:

- Part 1 – Individuals

- Part 2 – Businesses

- Part 3 – Representation, Practices and Procedures

Step 10: Apply for Enrollment at Pay.gov

Once you pass all three sections of the SEE, you will need to register as an Enrolled Agent. The application can be found at Pay.gov.

Step 11: Pass a Tax Compliance Check with the IRS

The Tax Compliance Check is basically a background check that begins once you submit your application (see Step 10). It takes up to 90 days.

Step 12: Spread the Word! You’ve become an Enrolled Agent!

Congrats! You’ve gained the highest credential in the tax industry! Tell your clients and add that designation to everything: your desk placard, business cards, email signature, and LinkedIn profile.