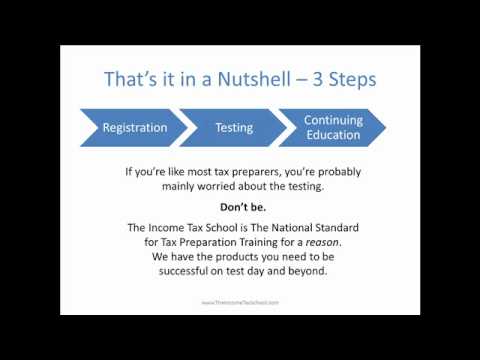

The Income Tax School will meet New IRS Regulation Guidelines for Tax Preparers to complete IRS Competency Exam and yearly continuing education requirements

You can count on The Income Tax School (ITS) to meet the new standards the IRS has announced for Tax Preparers. Since 1989, ITS has been training those interested in becoming tax preparers, as well as tax professionals wanting to continue their education.

You can count on The Income Tax School (ITS) to meet the new standards the IRS has announced for Tax Preparers. Since 1989, ITS has been training those interested in becoming tax preparers, as well as tax professionals wanting to continue their education.

The Income Tax School series of individual and small business tax preparation courses provide our students with in-depth knowledge of all topics that will be covered by the IRS Exam of basic competency for tax preparers. Our tax course students who successfully complete the appropriate course(s) will have the tax knowledge to easily to pass the IRS exam.

Details of the IRS Basic Competency Exam:

- The IRS Exam covers the 1040 series of tax returns, related Forms and Schedules, and ethical responsibilities of Tax Preparers. Our Comprehensive Tax Course will provide you with the tax knowledge needed to pass the IRS Competency exam for individual returns.

For past graduates and experienced Tax Preparers we also have the following options:

For past graduates and experienced Tax Preparers we also have the following options:

The IRS has indicated that a second exam may also be introduced at some future time for tax preparers who also do non-individual returns such as Form 1120 Corporation and Form 1065 Partnership. Our Small Business Level I Tax Course will provide the knowledge needed to pass this IRS exam.

Your Success Is Guaranteed by The Income Tax School!

Your Success Is Guaranteed by The Income Tax School!

We’re so confident you will pass the IRS Exam after successfully completing our Comprehensive Tax Course that we’ll allow you to Repeat the Course FREE or receive a REFUND in the unlikely event you do not pass! Learn more about our Success Guarantee.

For more information about the IRS Tax Preparer Regulation, check out our summary of the new regulations.

For questions, please call us at (800) 984-1040 or email us. Below is a short video for current tax preparers on the new regulations.