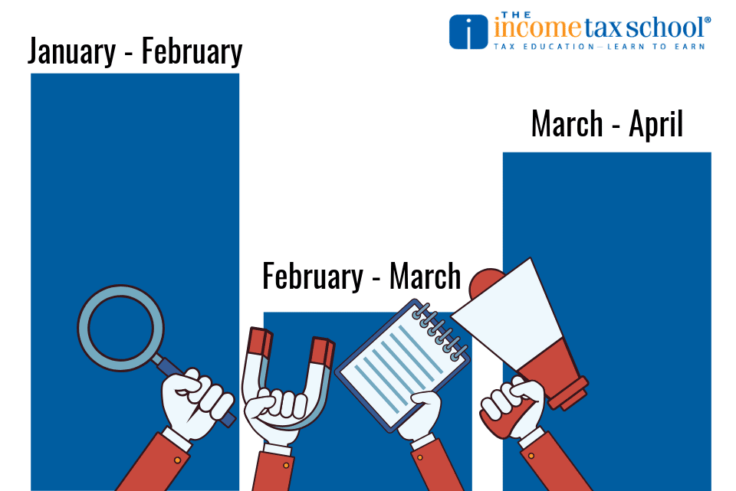

When it comes to marketing your tax business, the same messaging all year long is not going to cut it. As you progress throughout the season, your message needs to appeal to different types of taxpayers. Here’s a peek at what we do over at our sister company, Peoples Tax, and what we recommend for all tax firms throughout the season.

Start of the Tax Season

Your initial tax season marketing efforts should start in Mid-January and run through about mid-February. As a best practice, most of your marketing budget should be spent on this first flight to increase reach and frequency before many taxpayers have already filed. Once tax season gets underway, you’re

- A Facebook, LinkedIn, and/or Google advertising campaign to get people in the door and increase reach as much as possible.

- Messaging across all communications platforms (social media, blog, newsletter, etc.) about the importance of filing early.

- Personal invitations to current clients to make their tax appointments.

- Direct Mailers.

- Speaking engagements around town to increase your firm’s exposure.

Mid Tax Season

The middle of tax season should be lower key in terms of marketing spend, however, messaging across communications platforms should remain consistent. There is a smaller pool of taxpayers who need to file – some of them are motivated to do so, the others are procrastinating. You need to speak to both.

Here are some marketing activities to consider during the middle of tax season.

- Communications around not waiting until the last minute.

- Promotions around switching to your tax firm over another.

- Educational posts about the dangers of tax software.

- Reminders to clients who haven’t made appointments.

- Networking, networking, networking.

- Referral incentives.

- Communications around getting in to file as it might take longer this year.

- Education around the changes to the tax law.

Late Tax Season

The last 2-3 weeks of the tax season are for the procrastinators. They either haven’t had time to file, just don’t want to deal with it because it’s too complicated, or are afraid. You’ve got to speak to all of these fears and attitudes to bring those taxpayers through your doors. Focus on messaging that targets individuals with more complex returns and small businesses.

Here are some marketing activities to consider during the end of

- An advertising campaign that targets late filers and small businesses.

- Messaging around the filing deadline and information on how to prepare for a tax appointment.

- Testimonials from clients.

- Education around working with a tax preparer to alleviate fears.

- Messaging around filing an extension before the deadline.

Post Tax Season

As you know, tax season isn’t over after April 15th. Every year more taxpayers apply for extensions. Many of these taxpayers will need help during the off-season and tax preparers should make themselves available to serve them. So far this year, according to the latest IRS statistics, extensions are up by more than 25% over last year.

While it may be useless to do any paid advertising at this time, you definitely shouldn’t abandon communications. For one, you need to reach out to clients who filed with you this year to thank them and get them to take a post-tax season survey. Surveys help gauge client satisfaction and serve as a way to evaluate your tax season. For two, you need to communicate that you’re still taking clients and would be happy to file regardless of the deadline. Messaging should be around what to do if they missed the deadline, and why they should make an appointment as soon as possible.

Tax season marketing doesn’t have to be complicated if you have the right plan and tools to execute. If you’re looking for a resource that outlines exactly what do, check out our Tax Practice Management Tools.