Are you ready for the upcoming season? If you haven’t renewed your PTIN then the answer is no. Anyone who prepares or helps prepare federal tax returns for compensation must have a valid Preparer Tax Identification Number (PTIN) from the IRS. The PTIN is an identifying number for a specific tax preparer on returns prepared.

who prepares or helps prepare federal tax returns for compensation must have a valid Preparer Tax Identification Number (PTIN) from the IRS. The PTIN is an identifying number for a specific tax preparer on returns prepared.

All current PTINs expire on December 31, 2016 and can be renewed at www.irs.gov/ptin. You’ll want to get your PTIN secured as soon as possible to avoid the end of the year rush.

But your PTIN shouldn’t be the only thing you secure before the season starts. Here are some other ways to prepare yourself for the upcoming season.

Participate in the Annual Filing Season Program (AFSP)

The voluntary IRS Annual Filing Season Program (AFSP) is intended to encourage non-credentialed tax return preparers to take continuing education (CE) courses to increase their knowledge and improve their filing season readiness. Participation generally requires 18 hours of CE, including a 6-hour Annual Federal Tax Refresher (AFTR) course in basic tax filing issues and updates, ethics, as well as other federal tax law seminars.

Enrolled agents and participants in the Annual Filing Season Program are included in the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications created on IRS.gov to help taxpayers make wise decisions when choosing tax return preparers.

The Income Tax School is an IRS approved provider. Find out more about taking the AFTR course and other AFSP continuing education.

Become a Licensed Enrolled Agent

The Enrolled Agent (EA) credential is an elite credential issued by the IRS to tax professionals who demonstrate special competence in federal tax planning, individual and business tax return preparation and representation matters. EAs have unlimited representation rights; allowing them to represent any client before the IRS on any tax matter. As non-credentialed return preparers consider the next steps in their professional career, the IRS encourages them to consider becoming an Enrolled Agent.

The Income Tax School offers very comprehensive EA Exam Study Guides to help you secure your EA designation.

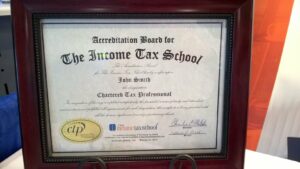

Become a Chartered Tax Professional (CTP®)

If you’re looking for a way to increase your knowledge to be able to serve more tax preparers this coming season but aren’t ready to take on the IRS Enrolled Agent Exam, our Chartered Tax Certificate Programs are perfect. The Chartered Tax Certificate Programs are unique because you have the opportunity to earn money as a tax professional while you study, which enables you to internalize the knowledge by applying what you learn…making you an even better tax preparer! With the talk of more requirements for tax preparers, many have decided to work towards becoming an IRS Enrolled Agent (EA). The Chartered Tax Certificate Programs are the perfect stepping stones to becoming an EA.

Another benefit is that upon completion you will receive an impressive certificate to display in your office to show your clients that you’ve completed a higher level of tax education.

There are so many tax preparers that simply “hang a shingle” and start preparing taxes with very little tax knowledge. Set yourself apart this tax season by going beyond the required PTIN with increased tax education and certificates to show for it.

More Great Reads

The Advantages of Taking the IRS Annual Filing Season Program

The Benefits of Becoming an Enrolled Agent

The Advantages of Taking the Chartered Tax Certificate Program