The IRS wants to remind holiday shoppers to remain vigilant with their personal information this holiday season. That means you should be communicating with clients to ensure they stay vigilant this December. In the hustle and bustle of finding the best deals…

Displaying: Recent Posts

Thankful for Our Family Business

The Income Tax School is a nationwide online tax school that serves thousands of tax professionals and students each year. While that takes an entire team of employees to run, at its core both The Income Tax School and Peoples Tax…

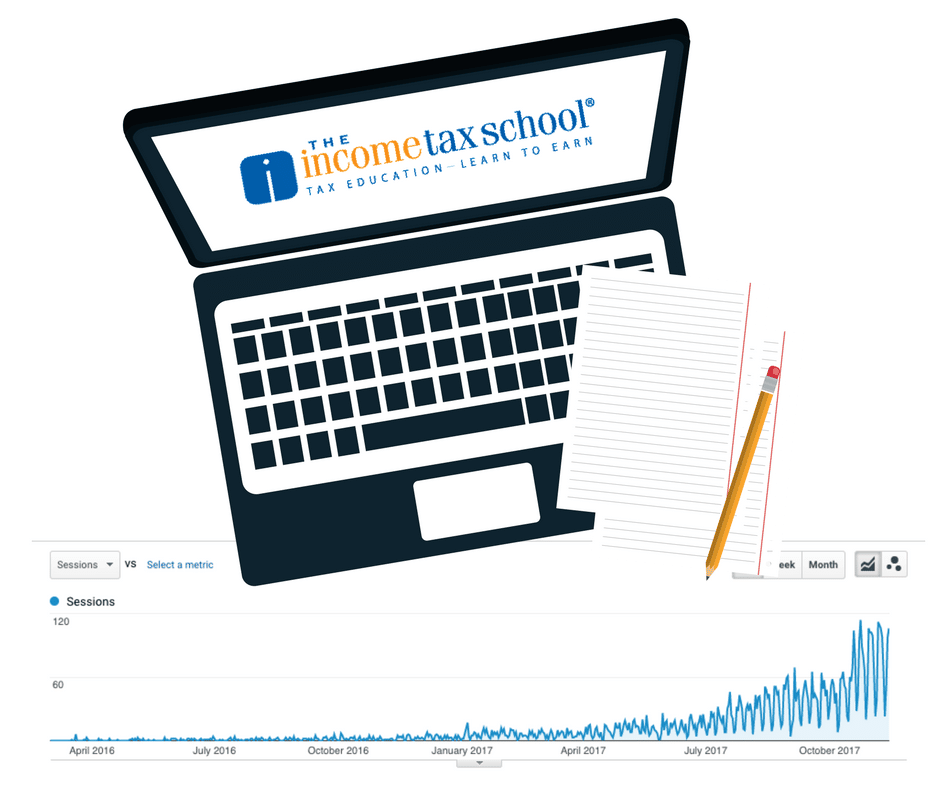

How One Blog Post Generated Thousands of Hits

Last year we wrote a blog post on the Peoples Tax blog (our sister tax preparation company) with line by line explanations on filling out a W4. Each month, no matter what we write about, this blog is the most visited…

Are You Investing In Your Employees?

Your employees are the heart and soul of your business. They keep your clients happy and they keep operations running. It’s important to make sure that you take care of them. Not only do happy employees make for happy clients, it’s expensive…

Time to Set Year-End Tax Planning Appointments

The holidays are quickly approaching – which for the tax industry means year-end tax planning should be on your radar. Have you reached out to clients yet? It’s important that both individual and business clients consult with you to make tax moves…

Tax Preparers Beware: Cybercriminals Are Out to Get You

Cybercriminals are targeting a new group lately: tax preparers. Cybercrime has become serious business in the past few years as new, more sophisticated scams crop up. Cybercriminals have realized – why target one tax payer when you can breach an entire tax…

IRS Don’t Take the Bait Recap

Have you been following the IRS Don’t Take the Bait series? This 10-part education series was part of the IRS Security Summit effort. Data breaches and scams have been steadily increasing and are getting more and more sophisticated. The purpose of the…

IRS Nationwide Tax Forum Recap

Our team had such a great time this year attending the IRS Nationwide Tax Forums! We were in Orlando, Las Vegas, Dallas, National Harbor, and San Diego meeting with tax preparers and talking about tax education. We love meeting new people, answering…

Digital Access – EA

Free Resources for Tax Preparers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders. That’s why, along with all of the materials and support we provide to students, we also strive to…

Protect Your Clients From Cybersecurity Threats

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to…

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to…