Tax season might be over and summer/vacation time may be in full swing, but here’s something to keep in the back of you mind: there are about 257 days until the start of next season. So why not Carpe Diem – or better yet seize the summer to ensure you are spending the off-season making moves that will earn you more income next season?

Here are five ways to seize the summer and make more money next tax season.

Build relationships

Don’t wait until December to start reconnecting with potential clients. Keep building those relationships by regularly attending networking meetings, lining up speaking engagements, sending emails and engaging on LinkedIn.

You should also spend the off season trying to build up your email list so that you have a good pool of people to reach out to when tax season comes. Make sure there’s a way for people to sign-up for your email list from the home page of your website and create free downloads in exchange for an email address on social media.

Read: How to Stand Out on LinkedIn

Improve processes

Dive into customer surveys and feedback and make an action list of ways to improve for the next season. Are there new processes that need to be developed? New offers you should consider? Evaluating your tax season is very important.

Read: How to Evaluate Tax Season

Learn more to earn more

Tax preparers who can prepare complicated returns earn more money because those types of returns are a higher dollar. Why not spend the tax season learning as much as you can so you can diversify your offerings next season?

The Income Tax School offers Chartered Tax Certificate programs that will not only increase your knowledge but will enhance your reputation as a trusted tax professional and give you a competitive advantage in your market.

The beauty of our courses is that you can take them at your own pace from anywhere and get instructor support.

Steal strategies from the pros

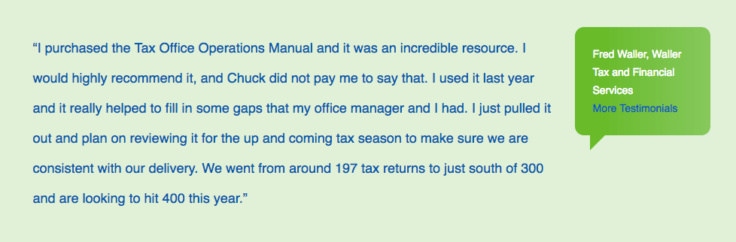

Are there areas of your business you know you need to improve upon? You don’t have to reinvent the wheel to be successful. You can borrow ideas from companies that are already successful. The national tax firms have spent years developing and testing systems that produce consistent and reliable growth. You can apply the same strategies they use to build your business with our Tax Practice Management Manuals.

Develop a content plan

Internet marketing has become a powerful force in business. Its success is dependent upon valuable and well-planned content. Now is the time to start mapping out your editorial calendar for next season (and the off season as well). Here are some articles that will help get you started:

5 Essentials to Develop a Client Newsletter

Social Media Guide for Tax Business Owners

Social Media Checklist for Tax Preparers

To quote Jim Rohn, “Successful people do what unsuccessful people are not willing to do. Don’t wish it were easier; wish you were better.”