This last year has been an interesting one to say the least! As we close out this extremely challenging year, I thought I’d reflect on some of the biggest news 2020 has given us.

In the news

On March 11, 2020, the World Health Organization declared COVID-19 a pandemic, almost two months after the first case was discovered in the United States. Businesses closed, we ran out of toilet paper, and the world learned together what it meant to be socially distanced and quarantined. We went through the summer facing civil unrest and when the school year started we all embraced virtual learning while also learning the value of a good internet connection.

We saw event after event cancel. We’ve celebrated birthdays, weddings, and holidays virtually, found ourselves outside more because… what else are we going to do? And, did I mention the murder hornets yet?

We also learned to slow down, wash our hands, and color coordinate our face masks. We got to work from home, wear lots of sweatpants, and be with our family. There was also Tiger King, Facebook Live concerts by our favorite musicians, Saturday Night Live at home, Dolly Parton (and many others) reading our children bedtime stories, and the cast of Hamilton performing for a fan on Zoom. If 2020 taught us anything, it was how to come together collectively to lift each other up.

In the Industry

As the world struggled with the pandemic, there were several changes on both federal and state levels to help those who needed the support.

The federal tax filing and payment deadlines were extended to July 15, giving those struggling some relief. Under the payroll tax deferral, employers were given the option to not to withhold the employee portion of the Social Security tax through the end of 2020.

This March, the Senate passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided $2 trillion in aid to hospitals, small businesses, and state and local governments, while including an elimination of the Medicare sequester from May 1 through Dec. 31, 2020. Under this huge piece of legislation, the bill included Expanded unemployment insurance (UI), $350 billion allocated for the Paycheck Protection Program, and Recovery Rebate for individual taxpayers.

Families First Coronavirus Response Act, H.R.6201 set up emergency paid sick leave and family leave requirements for certain employers, offset by refundable tax credits. It also increased funds for food aid and unemployment benefits. and requires insurers to provide coverage for certain coronavirus testing.

We also had student loan relief legislation passed in March that directed the office of Federal Student Aid to provide suspend loan payments, stop collections on defaulted loans, and set interest rates to 0% on ED-held federal student loans. That relief was extended through January 31, 2021.

In June, the IRS finally moved ahead on its plan to allow Form 1040X to be filed electronically and they pushed back EA Exams.

At The Income Tax School

Finally, we had our own big news and successes in 2020. We kept you up-to-date on industry news as we navigated working from home.

Pandemic or not, we ARE a remote learning institution. We didn’t stop working hard to ensure our textbooks were up-to-date and our students continued learning and got the instructor support they needed. We even offered financial support to those struggling.

We also told some great stories on the blog this year, like the one about our Course Curriculum Developer, Monica Brewer, who is running a successful business in Columbus, Georgia.

Or the inspiring stories of successful Black professionals in the industry.

To help tax business owners, we offered tips for leading through crisis, preparing for a pandemic tax season, and supporting clients virtually.

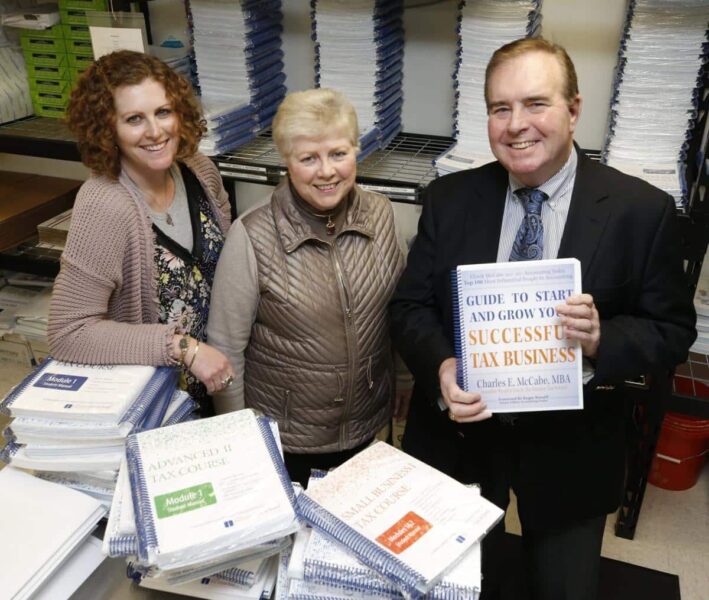

I am extremely proud of the hard work and excellent customer service we provided this year at The Income Tax School, which brings me to my final piece of news. The Income Tax School has officially been acquired by KnowFully Learning Group. Through this strategic acquisition, ITS will now operate under the name Surgent Income Tax School.

As someone who has been working to educate tax professionals for more than 40 years, I’m extremely pleased to be able to transition the leadership of The Income Tax School to the team at Surgent. Our missions are closely aligned and I look forward to this exciting next chapter for ITS. I am also looking forward to retirement with my wife, Marilyn, who has been by my side as a partner in both of our family run businesses. As I sign off on the last blog post of 2020 — and the last you’ll read from Chuck McCabe — I am truly honored to have mentored and helped so many. You can read more about the acquisition and my career in this piece by the Richmond Times Dispatch.