Savvy investors and real estate developers were excited when the Tax Cuts and Jobs Act was passed for a few reasons but one big one was the creation of “Opportunity Zones” (OZs). Opportunity Zones were created to spur economic growth in lower income communities by incentivizing businesses (in a big way) to invest.

What is an Opportunity Zone?

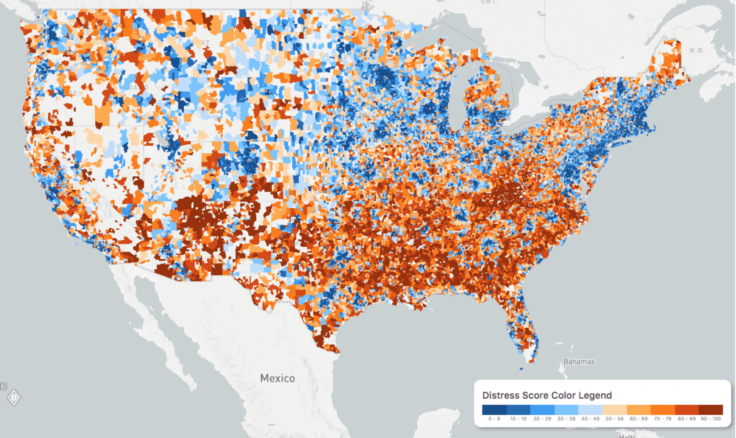

Opportunity Zones are defined as “economically-distressed communities where new investments, under certain conditions, may be eligible for preferential tax treatment.” There are currently 8,764 communities in all 50 states, the District of Columbia and five U.S. territories certified as Qualified Opportunity Zones (QOZs).

Why Should Entrepreneurs Care?

If you were already thinking about starting a business or investing in property, looking within your state’s opportunity zones could be the tax break you need. According to the IRS, “Opportunity Zones offer tax benefits to business or individual investors who can elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified Opportunity Fund (QOF). Investors can defer tax on the invested gain amounts until the date they sell or exchange the QOF investment, or Dec. 31, 2026, whichever is earlier.

The length of time the taxpayer holds the QOF investment determines the tax benefits they receive.

- If the investor holds the QOF investment for at least five years, the basis of the QOF investment increases by 10% of the deferred gain.

- If the investor holds the QOF investment for at least seven years, the basis of the QOF investment increases to 15% of the deferred gain.

- If the investor holds the investment in the QOF for at least 10 years, the investor is eligible to elect to adjust the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged.”

In other words, if you held your investment for 10 years, you pay zero capital gains tax in the fund, essentially paying no tax on your returns. That could mean a 30-40% increase in your annualized return, which is huge!

Help Spur Growth

The creation of Opportunity Zones wasn’t to just reward investors, it was to help strengthen and grow “distressed” communities. The creation of opportunity zones was meant to help distribute the wealth and revitalize communities across the country, offering good paying jobs and giving neighborhoods a face lift. That’s a lot of social impact you can have on your community by choosing to invest and hire in places that really need it. It also means adding new tax revenue to your local economy to help pay for improvements to roads, schools, and other services our tax dollars go towards.

Opportunity Zones and their benefits should not be overlooked – especially during COVID-19 when we are about to face a serious economic downturn. This is a great way for a business to get a fresh start and a community to begin the revitalization process. Learn more about OZs and their tax benefits on the IRS website here. Forbes also has a great piece on the nuts and bolts of Opportunity Zones here.