Today is National Checklists Day so we are celebrating by compiling all of the checklists you’ll need to prepare you for this coming season. Whether you’re a student, a tax preparer, a tax business owner, or looking to start a business – we’ve got a checklist for you!

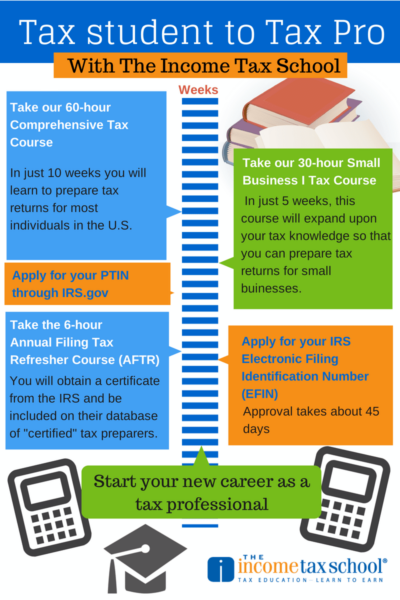

Looking to Get Into Tax Preparation?

Here’s what you need to get started before the 2015 season:

- Enroll in tax courses (beginner and/or advanced tax courses)

- Read the New Rules for Federal Tax Return Preparers

- Purchase and read Surgent Income Tax School’s Tax Practice Management Manuals

- Join our LinkedIn group to interact with other tax professionals and stay on top of industry news: Tax Business Owners of America (TBOA)

- Consider joining the National Association of Tax Professionals (NATP)

- Register with the IRS as a Tax Preparer – Get Your Preparer Tax Identification Number (PTIN)

- Apply for IRS Electronic Filing Identification Number (EFIN) so you can e-file tax returns.

- Order tax preparer software (If you plan to start a business)

Read: How to Become a Tax Preparer and Start Earning Money Before Tax Season

Looking to Start a Tax Business?

If you are currently a student or already a preparer and you know starting your own tax business is the way you want to go, here’s how to get started:

- Learn Tax Preparation

- Obtain a PTIN and EFIN

- Purchase Professional Tax Preparation Software

- Choose a location (home or office)

- Write a business plan

- Get an online presence

- Check out the Intuit Tax Education Program powered by The Income Tax School

Read: How to Get Your Tax Business Off the Ground Before Tax Season

Read: Five Best Practices to Starting Your Own Tax Business

The Ultimate Tax Season Preparation Checklist

Just looking for a great guide to ensure tax season readiness? Here’s your checklist:

Personnel

- Hired the proper amount of staff and determined availability to ensure coverage over the tax season.

- PTINs obtained or renewed through IRS by all tax preparers.

- Hired seasonal receptionist/administrative assistant(s).

- Employment documents (applications, I-9, W-4, etc.) completed for all new employees.

- Employment Agreements signed by all tax preparers (including non-compete, non-solicitation & confidentiality provisions).

- Written the employee schedule for at least the first month.

- Held or scheduled pre-tax season meetings: one with your corporate staff and one with your office managers.

- Trained all new associates.

- Trained all new preparers on tax software and on your policies and procedures.

- All preparers have completed their CE courses.

- All preparers are informed of the changes to the tax law for the upcoming season.

Tax Operations

- Sent letters to clients to encourage them to come in early to have taxes prepared before January 31st

- Mailed tax organizers and cover letters to complex return clients and scheduled appointments with them.

- Set fees and charges for the new tax season.

- Reviewed and updated policies and procedures.

- Updated all tax software.

- Installed current year tax software with customized fields for pricing, client sources, etc.

- Establish Refund Transfer bank relationship if applicable.

- Set-up e-filing system.

Office

- Signed lease for all locations.

- Taken inventory of all maintenance issues and either fixed or created an action plan for repairs before the season begins.

- All signage is properly lit and in good working order.

- If you are leasing a mall office, ensured that it is properly set-up and ready to go.

- Ordered office supplies and updated inventory.

- Arranged for phones and utility to be operational for all tax office locations.

- Cleaned office interiors and windows.

Equipment

- All office computers are in good working order (purchased new ones if necessary).

- Updated all computer software.

- Arranged to have computer support personnel for any issues during the season.

- Purchased any necessary additional equipment.

Marketing

- Contacted previous clients for business this season.

- Written and/or sent out newsletters.

- Prepared a content plan for your website and social media sites.

- Arranged for any PR campaigns (ie. guest posts, press releases and articles).

- Scheduled seminars out in the community.

- Created and printed fliers, marketing materials, and brochures.

- Created an internet marketing plan to include Google and/or social ads.

- Purchased any advertising (newspaper, direct mail, TV, radio, sponsorships, etc.).

Read: Are You Prepared for This Coming Tax Season?

Want to grow your business?

Here are few checklists to ensure you are getting the exposure you need!

The holidays are around the corner, don’t miss these great opportunities to gain exposure before the season starts:

- Send Christmas cards and offer a discount for scheduling a 2015 tax appointment early or coming in before February.

- Host a charity event or a holiday open house at your office for clients and professional contacts.

- Take advantage of the many networking events that happen during the holidays. It’s a great way to meet people and hand out business cards.

- Conduct a year-end tax-planning seminar.

- Write an article on year-end tax planning. You can post this on your blog and social media sites or offer it up to a local news site or publication.

- Send a newsletter to clients as well as professional contacts.

- Sponsor events held by other local organizations like the chamber, BBB, or Retail Merchants Association.

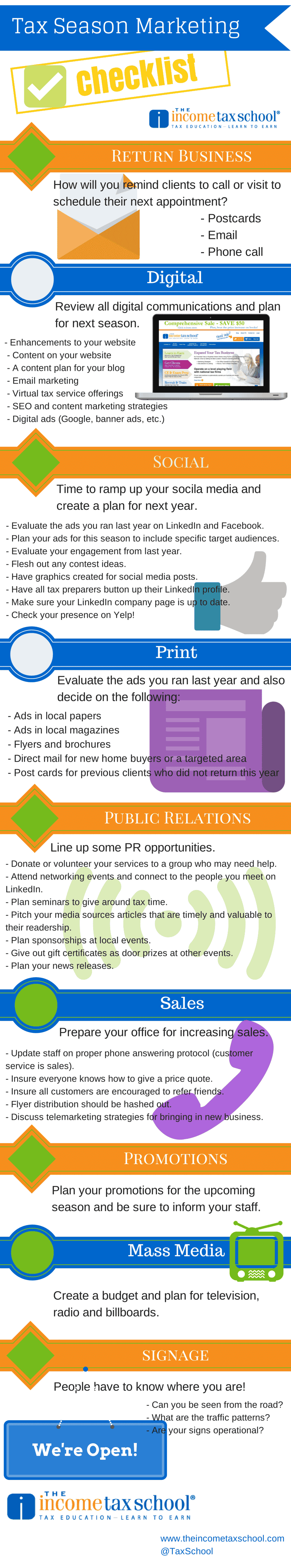

Here’s the ultimate marketing checklist:

For more details, read: The Ultimate Marketing Plan Checklist For Tax Season Readiness

Another great read: Six Things Every Tax Business Owner Should Do to Grow Their Business

Looking for hiring or operations lists?

Here are three great posts that will help with tax office operations.

Tax Offices Shouldn’t Operate Without Operations Manuals

What You Should Include in a Non-Compete and New Employee Packet