Getting ready for the upcoming tax season can mean a lot of things for tax preparers and tax business owners. One thing that should be a priority for both is knowing what will change in the 2014 tax code. Tax laws change…

Displaying: Operating Your Tax Business

Tips for Training Staff Before Tax Season

If you are hiring and training new staff for the upcoming tax season, there are several things you should incorporate into training to ensure you and your staff are well prepared for the new tax season. Training Tax Preparers If you are…

4 Game-changer Internet Marketing Lessons I Learned

When I founded Peoples Income Tax in 1987 the Internet was in its infancy and was certainly not an option to market our tax business. However, as the Internet grew rapidly, we decided to create our first website, www.peoplestax.com, which we…

Financing Operations Until Tax Season Starts

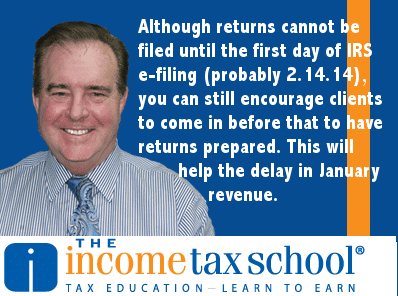

It should be no surprise by now that the 2014 tax season will be delayed by up to two weeks. For tax preparers, this means that you will be losing out on two week’s worth of revenue until the tax season starts. …

Social Media Tips for Tax Preparers

If you’re in the tax industry, you know that being knowledgeable about the tax code is not the only important credential you need to do your job. You also have to be good at building relationships, customer service, and networking to gain…

Why Your Tax Firm Should Be Hiring and Training Now

As you prepare for the upcoming tax season, you should also begin hiring and training the staff you will need to run your business in the upcoming year. Ideally, running a tax school during the off-season is the best way to…

The Affordable Care Act: What You Should Know as a Tax Preparer

As we draw closer to 2014, the media continues to increase their coverage on the Affordable Care Act and how this round of implementations will affect people. For the uninsured, the Affordable Care Act means that they will have to begin the…

Three Ways to Gain Repeat Business and Recommendations

Top three factors for income tax preparers to ensure your clients return and recommend you to others As an income tax preparer, your business model relies heavily on repeat business. Not only do you have to continue gaining new clients, you need…

What Should Your Tax Office Include in its Non-Compete?

As a tax professional, the work you do for your clients is very customer service oriented. Good tax preparers build very strong relationships with their clients as they begin learning a very personal part of their lives: their finances. Tax preparers become…

15 Test-taking Tips for the RTRP Exam…… FREE White Paper

This Free white paper will help you to become familiar with the IRS Registered Tax Return Preparer (RTRP) Exam and be prepared to pass the test. The white paper also provides links to additional valuable free information and resources. If you want…

Should you get out of the ‘fast refund’ business?

If you are an independent tax business owner who is capable of preparing complex tax returns, the answer may be “Yes”. The latest proposal is for IRS to develop its own free tax preparation software to “cut-out the middle man” (tax preparers). …

IRS Urged to Provide Its Own Tax Software

Click to view full article at AccountingToday for the Web CPA