In a straightforward, plain-talking news release (which is refreshing from the IRS), the Taxpayer Advocate Service (TAS), an independent organization within the IRS that helps taxpayers and protects taxpayer rights, released two important items:

- A special report on how better to administer the Earned Income Tax Credit (EITC), so the people who need it get it and to reduce fraud at the same time

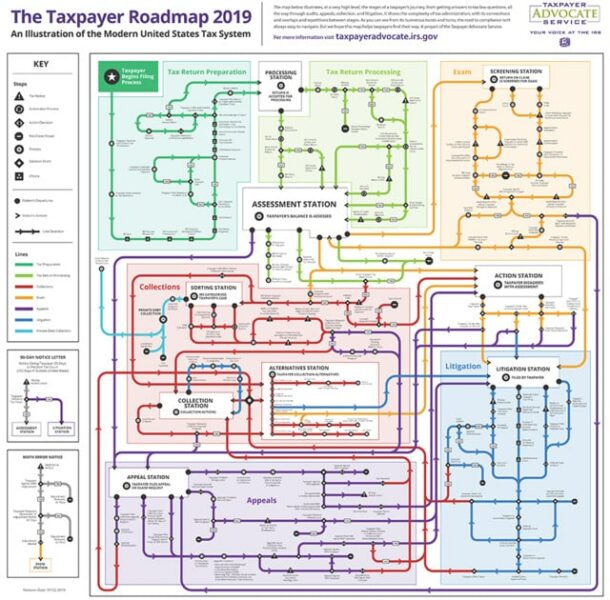

- A “subway map” that “illustrates, at a very high level, the stages of a taxpayer’s journey through the tax system – from getting answers to tax law questions through audits, appeals, collection and litigation”

The Importance and the Mission of the EITC

National Taxpayer Advocate Nina E. Olson is one of the lead voices on this EITC report, Earned Income Tax Credit: Making the EITC Work for Taxpayers and the Government. One of the very first messages in the report is that the IRS actually has two missions:

- To collect taxes

- To administer benefits, such as the EITC

She and the other authors point out that administering benefits requires a different perspective and set of skills; therefore, hiring the right people to carry out this particular mission is crucial to getting it right.

The report also makes a series of other recommendations, such as:

- Making sure family and child-related eligibility provisions are more easily verified, since provisions that aren’t easy to verify by the IRS put unnecessary additional scrutiny on taxpayers. Such provisions also risk taxpayers not getting the proper EITC payment to which they are entitled (either in their favor or not)

- Conducting regular Congressional oversight hearings with professionals outside the IRS, particularly those who specialize in low income benefits and tax prep, in order to get a better overview of what’s working and what isn’t in the field

- Redesigning the EITC to separate the worker component from the family-size component, as well as redefining the term “qualifying child” in an effort to “better reflect existing family relationships,” suggesting both measures could reduce fraud

- Establishing specific standards for tax return preparers and tax return software providers to “protect taxpayers and improve the accuracy of EITC claims”

You can read the full EITC report at the IRS website, as well as read the inspiring words of Olson, who says, “The EITC and I have been sisters-in-arms throughout my entire career in tax … It is fitting, then, in my last Report to Congress before I retire as National Taxpayer Advocate on July 31, 2019, that we should publish this extraordinary document.”

Subway Map of Taxpayer’s Journey Through Tax Preparation

In the past, TAS has released a series of tax preparation roadmaps in their annual reports to Congress. These roadmaps break down the tax preparation process into seven components:

- Tax return preparation

- Tax return processing

- Notices

- Examinations

- Appeals

- Collection

- Litigation

The roadmaps show where certain sections intersect and even repeat. The biggest takeaway from these roadmaps is just how complex and difficult to understand the American tax system is. Olson herself has remarked about how difficult the roadmaps are even for tax professionals. If tax pros struggle with some of these concepts and processes, how can the average citizen be expected to understand them?

This new “subway map” is designed to represent a clearer visual representation of the tax return process. You can view it online or order a copy of it by calling 800-829-3676 and requesting Publication 5341. You can also watch a video introduction of the tax prep subway map.

If you’re interested in how TAS is working to bring transparency to the tax preparation process and advocate for the proper administration of the Earned Income Tax Credit, read IRS News Release IR-2019-123 to get more details and access to more resources.