“No man is an island; entire of himself…”

This famous line written in 1624 by English poet John Donne is still sage advice for anyone, especially an entrepreneur. If you’re satisfied being an independent contractor compensated directly in proportion to your personal services rendered, you won’t need a board. But if you want to build a company that will still have market value when you are no longer in the picture, you’ll need the advice and help of seasoned business experts with skills and knowledge you lack. No one is competent in every area of expertise needed to succeed in business. The most successful entrepreneurs recognize their limitations and bring in people with complementary strengths to counter their weaknesses.

Start-up companies often have a severe handicap. They are usually too risky to attract private investors and the high caliber board of directors needed to ensure their success. “Angels” know they are prime targets for unscrupulous people who would like to reach into their deep pockets. They are also adverse to unnecessary risk and usually prefer to minimize their exposure through syndication with other “angels” and professionals whose judgement they respect. Signing onto a formal board of directors of an unproven company about which they know little is just not prudent. So how can you as a struggling entrepreneur get these key people to buy into your company? Your solution may be an executive advisory board; it proved to be the answer for me.

After courting numerous prospective sources of debt and equity financing without positive results, I was running out of ideas. My attempt at an initial private placement (which I even presented at a major venture capital forum) not only failed, but it cost $25,000 that I didn’t have and a great deal of my valuable time. Then a good friend and advisor, Matt Alexander, sent me an article from the April 1990 issue of Inc. Magazine titled “Unlimited partners: How three company builders turn to their boards for answers.” The brilliance of creating a formal advisory board to solve my problems became crystal clear. I’d already identified several key people who had the resources, contacts, and expertise to ensure the success of Peoples Financial Services, Inc. Creating Peoples Executive Advisory Board was the hook needed to get these and other important players aboard; this decision proved a pivotal point in the Company’s success. My first step was to develop the following description for prospective advisory board members.

Membership Criteria

- The caliber of a major corporation top executive with a track record of exceptional achievement and success.

- Experience and expertise in one or more of the following areas of critical importance to Peoples’ development.

- Entrepreneurial Management

- Corporate finance and accounting

- Marketing

- Sales and promotional

- Computer systems and MIS

- Commercial and investment banking

- Corporate and securities law

- Key strengths and circle of contacts should complement and not closely duplicate those of other advisors.

- Open-minded, innovative, willing to voice and defend ideas, and a team player.

Responsibilities:

- Attend meetings regularly

- Learn about the company and the industry

- Promote Peoples Financial Services:

- Refer clients when appropriate

- Be alert to business opportunities

- Provide advice in all key areas of decision making

Support:

- Meeting agenda, prior meeting minutes, financial statement and other pertinent information to be provided one week prior to each meeting.

- Reminder memo and phone call prior to meeting date.

Incentives for Advisors:

- Stock option (no cash remuneration).

- Reimbursement of any authorized expenses incurred.

- Opportunity for future board of directors seat with pay and additional stock options.

- Insight into future investment opportunities in Peoples.

- Possible sale of professional services to Peoples.

- Interaction with a group of top business leaders.

- Being part of the development of a future Fortune 500 company.

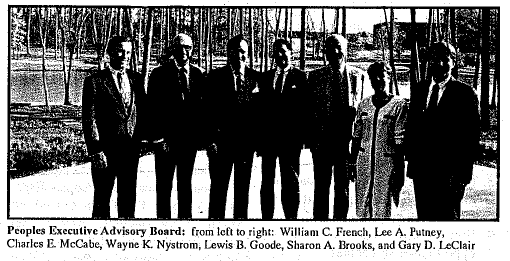

I invited seven people initially to join Peoples Executive Advisory Board and six accepted. The highly accomplished group of six professionals and entrepreneurs collectively provided the expertise and experience needed to complement me as President and CEO.

About one year after Peoples Executive Advisory Board was formed, all advisors plus a friend of each of the two senior advisors participated in Peoples’ first successful private stock offering. As insiders, the advisors, without exception, were confident enough to invest even though Peoples had not yet turned a profit. That equity capital made Peoples’ continued expansion possible. Upon expansion, revenues more than doubled that of the previous year and profitability was assured.

Funding was by no means the most significant contribution of the board. Far more valuable than money was the expert guidance this elite group provided to help me develop the strategies and tactics to achieve Peoples’ impressive growth. Their expertise was even more crucial as Peoples’ continued with an aggressive expansion.

The doors that were opened by such high profile advocates provided Peoples with an invaluable competitive advantage. My hope as an advocate of small business development is that some of you reading this article – entrepreneurs and prospective advisors – will benefit from this example as I did from the advice of my good friend Matt Alexander. A strong advisory board can work wonders for a struggling start-up company.