Email newsletters are a great way to keep in touch with clients year-round. They add a personal touch, keep clients in the loop, and are sharable. We’ve discussed their importance before, but have yet to go into developing a solid newsletter. We got a great question on a recent blog post (5 Marketing Things to do this Summer) about developing client newsletters so we decided to do a post about it!

If you’re thinking about email marketing, here are 5 essentials to developing a client newsletter.

Planning

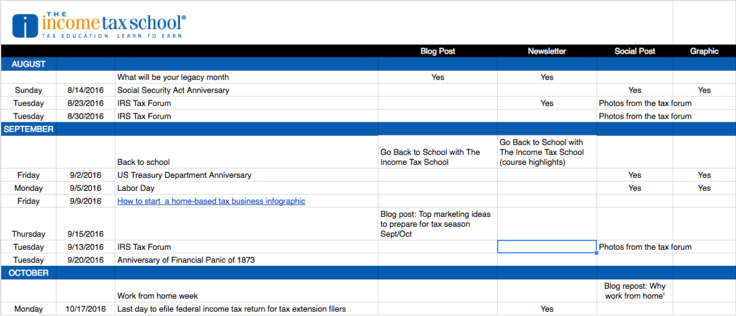

As with any marketing effort, the first step is planning. You should have an editorial calendar that maps out important dates, holidays, promotions, etc. This is the skeleton for what will become your newsletter. Start with a spreadsheet that has important dates (like filing deadlines, start to the tax season, etc.), seasonal topics (like Back to School or Tax Season), and holidays (Labor Day, Christmas, etc.). These will be the bare bones of your calendar and will help you plan out what to put in each email.

There are a lot of editorial calendar templates online that can be downloaded and used – it all depends on how detailed you want to get and how much content you are planning. Here’s an example of one.

Topics

Once you have a general idea of seasonality, it’s time to start planning specific things to talk about. You don’t want a newsletter full of self-promotion but you also don’t want to be boring. Think about what your clients will find interesting or useful. What do they need to know? How can you offer up advice seasonally? What’s top of mind for them right now?

Take a look at your editorial calendar and start planning out specific topics. For example, September is Back to School season, what tax tips can you offer up for parents or students? Write down your content ideas either on a separate tab in your spreadsheet or within the spreadsheet itself. Make sure you cover topics that will appeal to all of your clients. For example, our Peoples Tax newsletter always has a section specifically for business clients.

Frequency

During the off season, a monthly newsletter is probably the best frequency. Once tax season starts, consider sending out weekly or bi-weekly newsletters to make sure you are top of mind during your peak season.

Important Items to Include

Lastly, make sure you include the following essential items in your newsletters.

- Links to your social media channels

- Links to any blogs you’ve written

- Contact information

- Important dates

Email newsletters are fun to put together and a great planning tool. You may find, once you’ve gathered all of the content together, you have plenty of material to use for posts on your social media channels. Keep your clients informed, stay top of mind, and help yourself plan for the months ahead by creating regular email newsletters.

More Great Reads

Are you Communicating Enough with Clients and Staff?

One Easy Tactic to Gain Client Loyalty and Increase Referrals

The Ultimate Marketing Plan Checklist for Tax Season Readiness